Have you ever asked yourself how many days’ elapse between the processing and posting date for postings within your company? Perhaps those of you in Germany have heard of the abbreviation GoBD, a set of accounting principles on proper book-keeping (German: GoBD) related to Germany’s Generally Accepted Accounting Principles (GAAP) (German: GoB), but didn’t really think about what their significance might be, or how they should be taken into account? Perhaps you have a similar set of principles in your country?

The aim of this blog post is to finally put an end to all the confusion and shed some light on the matter once and for all.

Part III of the series: “Recording of postings in a timely manner”

1. Don’t put it off until tomorrow… recording of postings in a timely manner

2. Quick Guide: Three steps to determine if postings are being recorded in a timely manner

3. Analysis of the continuous recording of postings over time

4. How you can notice which business transactions are being left undealt with for a longer period of time

Are companies legally obliged to comply with the GoBD?

Contrary to the popular opinion, there is no legal obligation to comply with the “Principles for properly maintaining and storing books, records and documents in electronic form and for data access” (German: GoBD). Even if the document reads like a legal text, it is more a case of a set of recommendations issued by the German Federal Ministry of Finance (BMF). If you want to consult the GoBD, you can download them free of charge by clicking on this link (in German only):

Why should my company nevertheless still comply with the GoBD?

The GoBD accounting principles set out a variety of criteria for the proper keeping of books and records. Formally, independent auditors are required to make checks based on these criteria to see if any careless errors or deliberate misrepresentation can be identified in the annual accounts. So, by adhering to the principles set out in the GoBD, you can avoid having to face unpleasant questions from your independent auditor or, worse still, possible legal disputes. Especially in large companies, the recommendations should be compulsory.

Which part of the GoBD does zap Audit cover?

As per Subsection 47 of the GoBD, every non-cash business transaction recorded within 10 days is classified as unobjectionable. Furthermore, in relation to cash payments, it says the following: “As per Section 146 (1) of the German Fiscal Code, cash receipts and payments shall be recorded on a daily basis.” (Subsection 48)

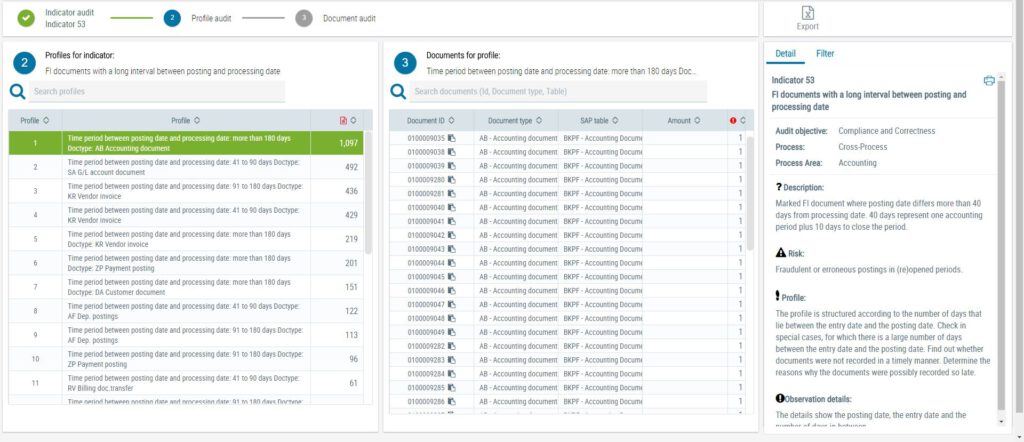

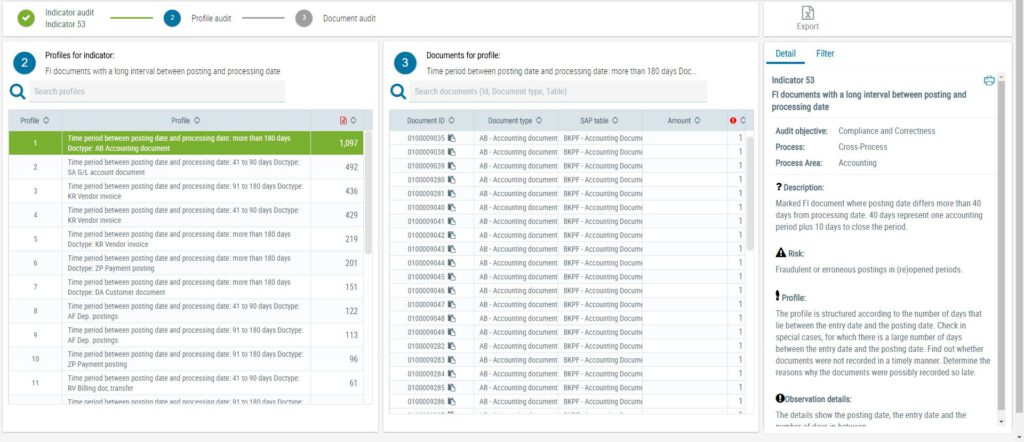

In zap Audit, we have implemented an indicator called: “FI documents with a long interval between posting and processing date” that automatically checks whether or not the aforementioned 10-day period is met. A FI document will be marked where an interval of more than 40 days has elapsed between the posting date and the processing date. This period of 40 days corresponds to one accounting period (30-day month) plus the 10 days allowed to close the period.

What kind of analyses can be performed with the data from zap Audit?

To perform a comprehensive analysis of differences between posting and processing dates, you can, for example, use a time-series analysis. This kind of analysis can, for instance, be used to identify personnel shortages during periods of peak activity at the company. The question to ask yourself in relation to such an analysis would be:

- Is the timeframe between the posting and processing date longer during periods of peak activity?

How to get data for an analysis of whether postings are being recorded in a timely manner?

If you want to analyze one-time invoices in your SAP, you need to retrieve the necessary data structures and data from your SAP system. Zap Audit extracts all the necessary data from your SAP system automatically. You can contact us here to start your own zap Audit project.

How to conduct a time-series analysis?

In zap Audit, the corresponding differences between the posting and processing date are divided into three categories:

Differences of between:

- 41 and 90 days

- 91 and 180 days

- More than 180 days

In addition, the document type will be added to the corresponding profiles, as you can see in the following screenshot from zap Audit:

Using the “Export” function within zap Audit, you can easily export the data shown in the screenshot. You will obtain all the profiles listed with the corresponding documents in one Excel file. Based on this data, we can carry out a time-series analysis.

To be able to see the differences between posting and processing date more clearly, I add two further columns:

- the month of the processing date

- the difference in days between the processing and posting date depending on the profile

To get the month of the given processing date, I use the following Excel function:

=TEXT(<cell with date>; „MMMM“)

In my export, the processing date / entry date was to be found in column “R”. Unfortunately, I could not use the profile itself, because the document type was also entered as part of the profile. But here we simply want to analyze the difference in days contained in text of the following form:

Time period between posting date and processing date: 41 to 90 days Doctype: SA G/L account document

To extract the differences in days out of the text contained in my Excel file, I simply need to use the following little trick. In Excel, you can search for the parts of text you need using this function:

=SEARCH(“<TEXT TO SEARCH>”; <CELL WITH TEXT>)

But the problem with this approach is that the SEARCH function returns a value that corresponds to the position where the text is found. If nothing is found, an error is returned. So, we also need to use the following function in Excel to check for an error:

=ISERROR(VALUE)

Furthermore, in order to differentiate between the types of profiles mentioned, I use the following function:

=IF(logical_test; [value_if_true]; [value_if_false])

If you put all the functions together, you will end up with this complex function:

=IF(ISERROR(SEARCH(“41 to 90 Days”; N2)); IF(ISERROR(SEARCH(“91 to 180 Days”; N2)); IF(ISERROR(SEARCH(“more than 180 Days”; N2)); 0; “more than 180 Days”); “91 to 180 Days”); “41 to 90 Days”)

As long as we have managed to get the values for all the lines, we can now proceed with the time-series analysis. To perform the analysis, we simply need to create a new PivotTable of the whole sheet. Simply select all the data using the CTRL+A command and then select “Insert – PivotTable”. Confirm with “OK”.

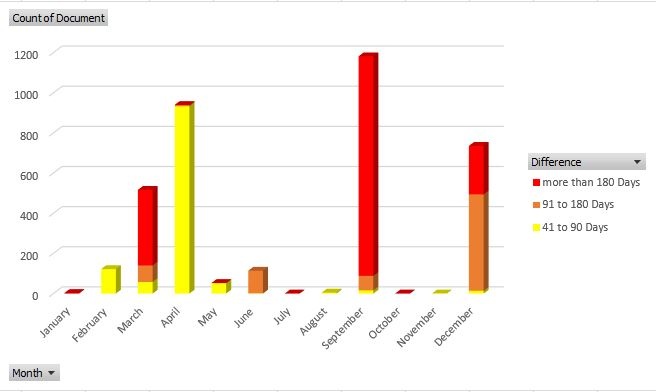

You will obtain a new sheet with an empty PivotTable, where we will select:

- Month as rows

- Difference in days as columns

- Documents as values

As a result, you will get a PivotTable with the amount of documents processed in the corresponding month. For a clearer overview of the results, we can now create a chart. I chose a 3D – column chart, under “Insert – Charts – 3D Column”. Your chart will maybe look like something like this:

You can clearly see an increasing difference in days from March to April and a clear peak in September with a lot of documents with a high difference between the posting and processing (entry) date. From here, I will leave it down to your Professional Judgment as how best to handle this situation, to discuss possible solutions with your departments, or think of possible ways of solving this issue.

In zap Audit, we have integrated a much more efficient process for the analysis of postings in a timely manner, so you don’t need to look up document types, processing and posting dates or examine any data on your own. In addition, we have added business intelligence methods and are constantly working to improve the algorithms used. That’s why you should automate everything that can be automated with zap Audit, and only audit, what needs to be audited.

What are your experiences of postings being made in a timely manner? Share your thoughts with us here.