A wide variety of questions may be raised when conducting analytics of the extensive usage of one-time accounts. The aim of this blog post is not to come down hard on staff members, but to check whether they are adhering to compliance guidelines or not. We also want to find out if they have been using one-time accounts intensively. In the end, it depends on your discussions with the departments concerned on how to proceed.

Part 4 of the series: “One-Time Accounts”

1. One-Time Accounts – The quick checklist for your accounting department

2. How to find one-time invoices in SAP in three steps

3. An unsparing look behind the scenes: How to analyze one-time accounts in SAP

4. Do you have power users with one-time accounts?

Basis for auditing one-time accounts

Before you start to perform your analyses, find out if there are existing compliance guidelines in your company on the use of one-time accounts. If not, you need to address this first by setting up a workshop / project. It may also be the case that there are existing guidelines, but the internal controls are missing or insufficiently defined. This blog post explains what you can do in this situation.

Usage of one-time accounts – one scenario

The usage of one-time accounts may also be a structural problem within your company, for instance if staff numbers have had to be reduced because of a reorganization. In such cases, existing members of staff may only manage to handle routine business, but not seasonal peaks. They may receive help from other in-house staff, but, due to insufficient training, one-time accounts are used as an easy way to settle overdue payments quickly.

Auditing one-time accounts

Once we have identified the existing one-time accounts in Part 2 of this series, we can investigate further based on these findings. If you missed this part, you can download the full guide here:

We will once again use the SAP transaction “S_ALR_87012291“ (Line Item Journal) here to look for power users of one-time accounts.

Step 1: Getting the data

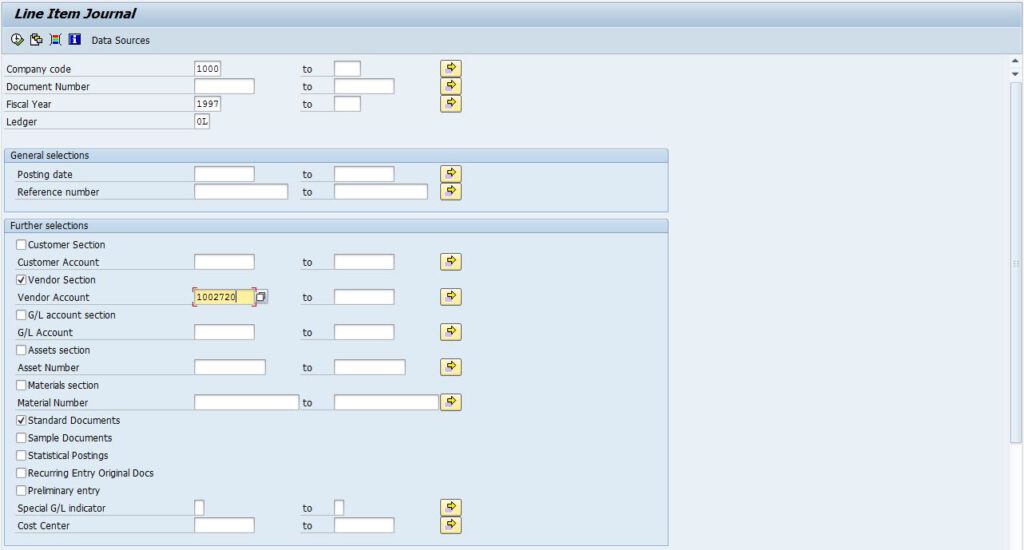

Because we have already identified all the vendor accounts, we can simply enter the company code, fiscal year and vendor accounts in the “Line Item Journal” screen. Once the fields have been filled out, you can uncheck all the other options under “Further selections” except for “Standard Documents” and “Vendor Section” of course. The screen should now look like this:

Execute by clicking on the Clock symbol or press F8 to generate a report. You can then export it to Excel by using the “Spreadsheet…” function or pressing CTRL+SHIFT+F7.

Step 2: Creating a PivotTable

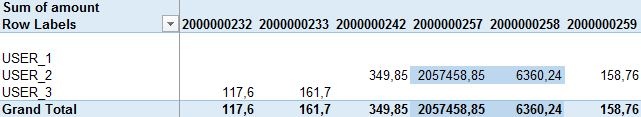

Open the generated report and select “Insert – PivotTable” to add a PivotTable to your Worksheet. In the screen which is displayed, simply select “New Worksheet”. Use the document numbers as columns, the name of the user as rows and the sum of the amounts as values. Because the results may be quite long and involve some high figures too, we can use “Conditional Formatting” to highlight the cells with an amount above the compliance guidelines in color. In Excel, we simply click on any cell in the sheet and navigate to “Home – Conditional Formatting”. Under Conditional Formatting, select “More Rules…” under “Top/Bottom Rules”. Apply the rule to “All cells showing “Sum Amount” values”, select “Format only cells that contain” as the rule type, switch from “between” to “greater than or equal to” and enter the limit from the compliance guidelines. Now we just need to set a Format. I choose “Fill – Select a color – OK”. That’s all for now. Accept and you will now be able to see all the Users who are posting above the limit. My part of the table, with a limit set at €6,000, looks like this:

Document number “2000000257“ looks particularly striking to me, because of the high amount. I decide to talk to the department concerned to check up on this document number further.

Step 3: The frequencies of one-time account usage

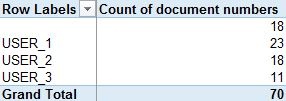

If you want to take these analytics further, you can also investigate the frequencies of one-time account usage. This can be done easily, simply by changing the document number in the PivotTable from the columns to the values section. You will obtain a smaller table with a count of the document numbers and the corresponding staff members. My data did not show any irregularities, as you can see in the following table:

The frequencies on their own are not very meaningful, but, as a next step, we could investigate whether one-time accounts were used for genuine one-time payments, or if they were used on multiple occasions to settle payments to the same vendors.

In zap Audit, we have integrated a much more efficient process for the analysis of one-time documents, so you don’t need to look up document types, or examine data on your own. In addition, we have added business intelligence methods and are constantly working to improve the algorithms used. That’s why you should automate everything that can be automated with zap Audit, and only audit, what needs to be audited.

What are your one-time account experiences? Share your thoughts with us here.