You want to avoid potential duplicate payments in SAP by using the internal control system (ICS)? Even before the postings are made in the financial accounting department? Then don’t miss out this blog post! I will show you the settings, how to develop them and where the limits are. Optimize your processes and reduce potential duplicate payments with a few simple tips and tricks.

Part IV of the series: “Uncovering duplicate payments”

1. Cashback: How the audit department pays off with duplicate payments

2. 3 steps for detecting duplicate payments in SAP

3. Duplicate Payments in SAP: Reducing False Positives using a Utility Analysis

4. How to prevent Duplicate Payments in SAP with the Internal Control System

SAP duplicate payments: Types of prevention in the internal control system (ICS)

Basically, we can differentiate between two types of prevention. On the one hand, there is the possibility to act on the company level. On the other hand, a monitoring on the overall level of the company can be established.

The possibilities on the company level are flexible and are depending on the case, e.g. missing control routines, insufficient master data management or disregard of specifications, like the posting of an invoice without an order. At this point, even SAP will not be taking a lot of work off your hands. So you need to spring into action. I recommend composing a team to develop approaches to eliminate the examples mentioned above. Of course, specific scenarios may exist that I have not considered.

Prevention on an overall company level

It looks completely different when monitoring on an overall company level. Some settings are already built in SAP that I will explain in the following of this blog post. This blog posts starts at the SAP customizing settings and shows the complete setup to using the internal control system of SAP.

How the prevention of SAP duplicate payments works

As soon as you post an invoice in SAP, for example using the SAP transaction “MIRO”, two invoice validations are performed. But only, if they were activated beforehand. I will explain the activation in a step by step instruction at a later stage of this article.

How it is working technically

First, SAP is reviewing if the invoice document has already been recorded in the logistics accounting department. Afterwards a validation in the Financial Accounting (FI or RW) will be performed and the following criteria will be checked.

The standard system of SAP validates the following criteria of an invoice with another document:

- Supplier/ Vendor

- Currency

- Company code

- Gross invoice amount

- Reference document number

- Invoice document date

Depending on the validation (logistics or FI / RW), different criteria are validated automatically. The difference between the logistics validation and FI / RW validation is the reference document number. While the logistics validation is checking each criterion, the FI validation differs, depending on the reference document number. If you enter the reference document number, the FI validation will leave out the gross invoice amount. If not, it will check the amount instead of the reference document number. I summarized this characteristics for you in the following table:

| Logistics | FI / RW(with reference document number) | FI / RW(without reference document number) |

| Vendor | Vendor | Vendor |

| Currency | Currency | Currency |

| Company code | Company code | Company code |

| Gross invoice amount | Amount in invoice currency | |

| Reference document number | Reference document number | |

| Invoice document date | Invoice document date | Invoice document date |

Unfortunately, you will only receive a warning or an error message, if all the criteria,and only if all, mentioned above are matching with a document already being recorded in the SAP system. This already provides two limits. If one criterion will not match or might be slightly different, for example through a mistake (transposed digits in the reference document number), no warning will be given. In addition, no validation of credit notes or retroactive debit or credit will be made.

Relevant parameters in SAP

However, you can adjust the settings in your SAP system to raise the probability of preventing twice posted invoices.

Now you probably ask yourself, how is this supposed to work?

I will explain it to you!

You have the possibility to change customizing settings in SAP. But do not expect too much. There is only the possibility to change the following three criteria:

- Reference document number

- Invoice document date

- Company code

Under these circumstances, check if the declaration of the reference document number is an obligation in your company. Generally, it is the external invoice number that must be explicit, according to the german legislator. I prepared a step by step guide with colorful pictures about the related SAP customizing settings. You can download it here:

Of course, you can make a choice on the criteria SAP should validate. As soon as you went through the guide and unselected the relevant checkboxes in the customizing settings, SAP will conduct the validation based on the remaining criteria. Note: SAP only shows a warning, if all the criteria are matching, so we lower the threshold for the emission of the warning and therefore raise the probability for a prevention.

So far so good?

It would not be SAP if it was that easy, right?

By now, you only set the customizing settings for the validation at the level of the SAP company code. To control the validation on the vendor master level, the field “REPRF” must respectively be available and set while creating new vendor master data.

The field REPRF – entry for duplicate invoices

In addition to the settings for the validation at the level of the company code, you must set the customizing settings for the field “REPRF” in the vendor master data.

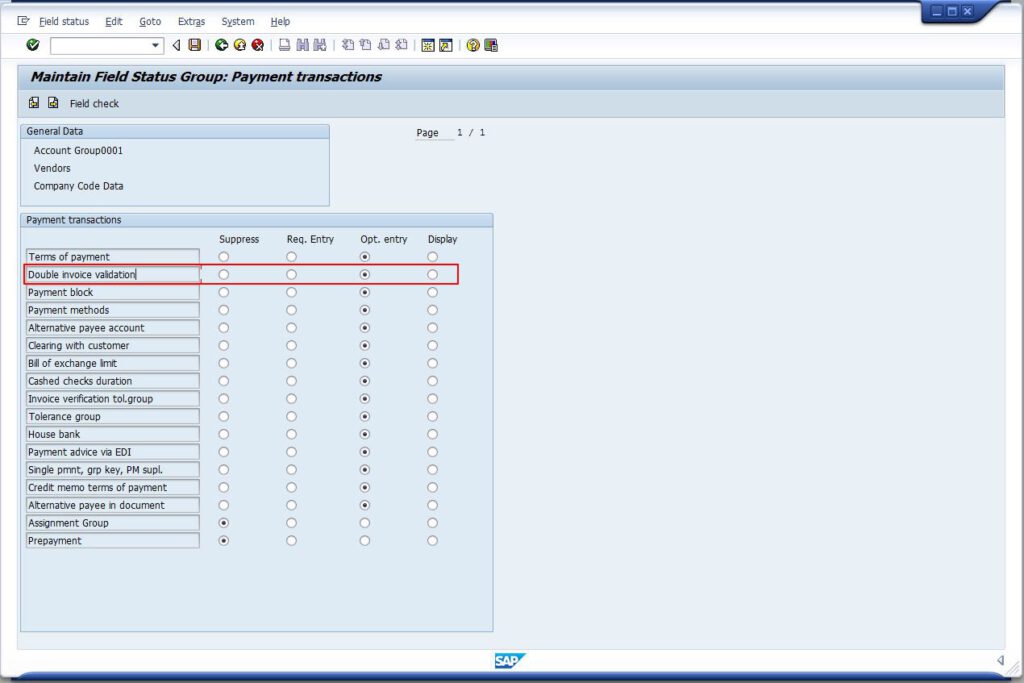

To do this, call the SAP transaction “OMSG“ and double click on the group “0001“ with the description “Vendors”. Now double click on the “Company Code Data” in the category field status. Then choose “Payment transactions“ in the area “select group” with a double click. Now you are in the vendor field status maintenance (Note: I also represented this process in detail in the instruction). You should get a similar picture:

The second option on the list is: “Double invoice validation”. As soon as you make this field a “required entry”, it must be selected when creating a new vendor / supplier. How this field should be set depending on your company and your compliance. In case it is set for a vendor, the modified criteria, as described above, will be automatically validated by the internal control system.

How to find out, if the field “REPRF” is set for my vendors?

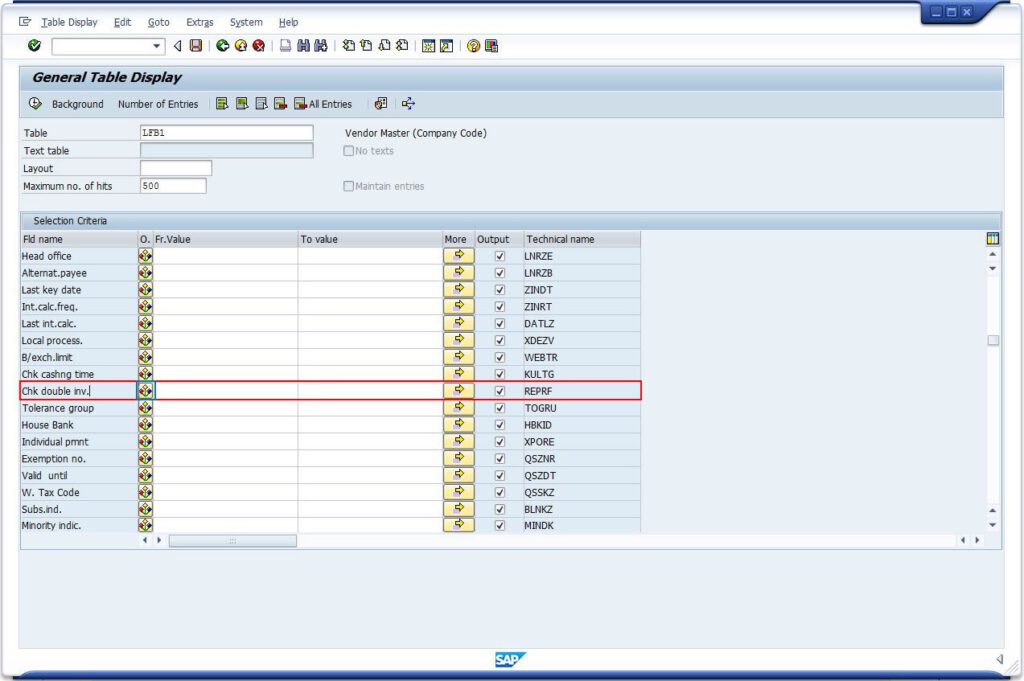

It is very easy to find out whether the validation for duplicate payments (“REPRF”) is activated or deactivated for your existing vendors. Simply call the SAP transaction “SE16n” or “SE16” (General table display). Under “table” insert “LFB1” (Vendor Master (Company Code)) and confirm with “return”. Afterwards scroll down a bit until you reach the field name called “Chk. double inv.” (marked red in the picture).

Afterwards, click on the symbol with the blue frame to select an option. Choose “Select: equal to” in the upcoming menu and confirm by clicking the green check symbol. You will get the results by clicking on the clock or pressing the key “F8”. You will obtain a list with all vendors / suppliers without validation.

Please note: To be able to carry out these settings in SAP, you need extensive SAP authorizations. Under these circumstances, turn to your SAP administrator and clarify the process with the concerned departments.

If you have any questions / suggestions / ideas, or already did duplicate payment analytics by yourself, please let us know here.